FORTY SEVEN (We are connecting financial worlds)

FORTY SEVEN (We are connecting financial worlds)

Forty Seven Bank ICO — What is Forty Seven Bank?

The Forty Seven Bank ICO is a fully integrated non-bank financial institution, compliant with all EU directives, Basel III, FCA, Banking Requirements Britain (PUU) and the Bank of England.

Forty Seven Bank aims to provide a broad range of digital and traditional financial products and services to individual consumers.

Forty Seven Bank is the bank of the future. It will be registered in the United Kingdom with the Financial Management Agency (FCA). The Bank will comply with all EU directives, including the Payment Services Directive (PSD2) effective this year.

The bank will specialize in digital financial services by fully supporting crypto and traditional currencies. The basic cryptocurrency procedures include buying, selling and investment options, and savings accounts. The Multi Property Account will be one of Forty Seven Bank’s outstanding innovative products — it will allow customers to access all of their accounts in the bank and secure electronic wallet and wallet. Invest and save their accounts in crypto accounts and corresponding accounts through an application. Can operate with each asset type by having only one multi-functional account at Forty Seven Bank

By creating the Forty Seven Bank Application Platform, we will allow fintech developers to enter the EU banking market without having to create the entire infrastructure. From the beginning and get the license for it. Developers will be able to create their own White Label bank and become a competitor to traditional banks.

Mission of Forty Seven Bank ICO

The mission of Forty Seven Bank is to create an innovative, flexible and open application platform for financial technology developers who will be able to operate under the roof of Forty Seven Bank, with access to Bank infrastructure and customer base. We will provide opportunities for developers with small or medium capital to create white label applications that will be able to compete with traditional banks. Our Banking solution as a Service (BaaS) will disrupt the financial sector of the European Union by reducing barriers to entering the Fintech market.

Forty Seven Bank ICO How does it work?

Forty Seven Bank will work as a regular bank with the addition of special services provided to users. They will have some features related to their cards. Between them, remote authorization and identification to ensure customer investment; Trades and withdraws any kind of cryptocurrency and an entire wide assortment of products with the help of a well-designed and well-designed user interface.

Businesses will also have special services such as mass debt repayment for investment markets, margin lending, and safe ways to receive money if they want to receive money in cash or in cash. Forty Seven Bank also plans to have development tools for developers looking to develop services based on the company’s architecture.

In this way, the company intends to have features for all types of users. All of them will be specially designed to fit their specific needs and be integrated into the system.

Forty Seven Bank ICO — Features and Technologies:

- Blockchain

- Biometrics

- Service-oriented architecture

- AI self-study

- Open API

- Smart contract

- Adaptive security architecture

- Conversational system

- Cloud computing

Forty Seven Bank ICO — Token (Seven Bank Token ICO)

Forty Seven Bank ICO (FSBT) is a foundation of the Forty Seven Bank infrastructure. FSBT credit cards will be required by partner developers to be able to upload their fintech applications to the Forty Seven Bank Application Platform. FSBT will also be required by businesses to improve the efficiency of their financial operations and operations through smart contracts. For Personal Customers FSBT credit cards will have a number of benefits when using Forty Seven Bank’s products and services, as well as cardholders who will be the top priority customers of the bank. Follow the loyalty program and receive loyalty / loyalty bonuses based on your bank’s performance. After the ICO crowdsale campaign ends, the FSBT cards will be available for trading at various crypto trading platforms.

Accepted payment ETH, BTC, Fiat

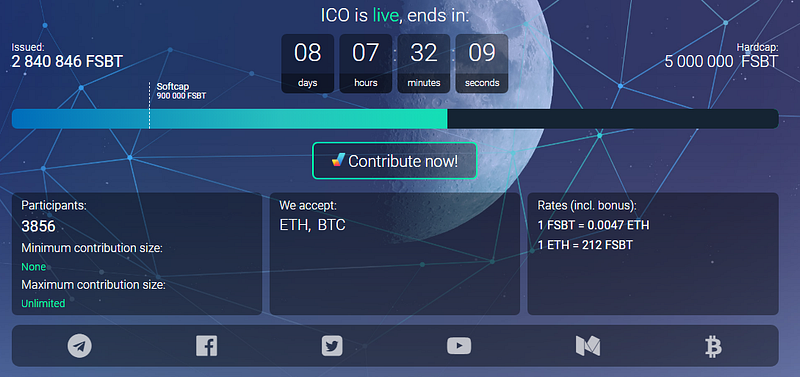

ICO: Underway — March 31,

Price: 1 FSBT = 0.0047 ETH

Reward: Up to 30% in Presale

Platform: Ethereum

Small market: 3,600 ETH

Target mobilization: 36,000 ETH

Country: Latvia

ICO round 1: 16/11–16/12/2017.

ICO Round 2: November 17 — February 28, 2018.

ICO round 3: 01/03–31/03/2018

Exchanges Forty Seven Bank plans to list on the exchanges after the end of the ICO

- Binance

- EtherDelta

- HitBTC

- IDEX

- LiveCoin

Roadmap

Q4 2016 — Building the Forty Seven Bank concept, project planning

Q2-Q4 2017 — Prepare and start crowdfunding through the Token Generation event

Q1 2018 — Complete Token Generation Event, start FSBT on the exchange platform

Q2 2018 — Deploying software infrastructure

Q3 2018 — Please EMI, PI authorized at FCA, integrated with SWIFT system

Q4 2018 — Obtained the license of EMI, PI, authorized for operation of FCA. Start service for FSBT cardholder

Q1 2019 — Apply for banking license

Q4 2019 — Having banking license. Start offering comprehensive banking services

Team

Aleksandrs Malins: General Director, Member of the Board

Igors Astapčiks: Operations Manager, Board Member

Vladimirs Tomko: Marketing Director, Member of Boa

Mihails Skoblovs: Chief Financial Officer, Member of the Board

Aristoteles Vargas: Chief Financial Officer, Board Member

Anton Antonatov: Technical Director

Edgars Abols: Legal Manager

Lilija Kovaļčuka: Artistic Director

Jevgenijs Lesevs: Internal Audit Manager

Vitalijs Grundsteins: Project Manager

Kristiāna Štauere: Principal Analyst

Nana Zhang: Community Management (Asia)

Reference Information:

Website: WWW.FORTYSEVEN.IO

Nhận xét

Đăng nhận xét