DEHEDGE ICO REVIEW — Risk-hedging platform for cryptocurrency investors

DEHEDGE ICO REVIEW — Risk-hedging platform

for cryptocurrency investors

If you’ve invested in an ICO in 2017, you know that ICO is a very risky venture and risk losing its investment. According to statistics, more than 90% of ICOs are fraud. The following numbers in 2017 are even more horrible: the $ 300 million invested by ICO has suffered a loss, with the $ 50 million loss in The DAO alone, about $ 7 million lost due to fraud in the ICO Deos ( According to CoinSchedule.com data in early October 2017)

Understanding that, DeHedge project was born with the desire to secure the investment of ICO investors.

DeHedge does this by setting up a hedge fund that will help investors be more comfortable investing in DeHedge’s selective ICO projects with more than 100 criteria as well as being thoroughly evaluated by DeHedge’s experts. .

DeHedge is a hierarchical hedging mechanism for kriptocurrency investors. DeHedge hedging on investing in ICO and crypto, protecting investors in case of exchange rate fluctuations, fraud and project cancellation.

We evaluate large-scale ICO projects using a single ranking model.

An investor can get hedging for many cases, such as project cancellation or reduction of exchange rates.

On March 18, 1818, DeHedge held the event, “Launching of hedging instruments for digital asset investment” on March 18, 1818, at TikTak CoWorking space,

An investor can get hedging for many cases, such as project cancellation or reduction of exchange rates.

On March 18, 1818, DeHedge held the event, “Launching of hedging instruments for digital asset investment” on March 18, 1818, at TikTak CoWorking space,

DeHedge is a hedging project for digital asset investors. The DeHedge concept was launched in August of 1977, with the foundation of a technology that links the financial and digital worlds. In addition to its principal function as a development agent for the protection of risk in ICOs investments, DeHedge simultaneously performs the functions of a guarantor, a vendor of structured finance products and a builder market

DeHedge’s mission is to develop digital asset finance and blockchain support projects by providing players with financial protection tools. At this point, DeHedge offers investors a unique product designed to protect their investment.

In fact, investor protection is extremely complex and depends on the purpose of the product at the time of development of the digital asset investment community. The use of DeHedge enhances transparency in the participant’s relationship, forms clear guidelines and increases capitalization. The DeHedge Platform opens and welcomes high quality projects that help them find investors.

In the Vietnamese market, DeHedge is determined to develop and implement risk insurance for the digital asset market and the initial offering of token projects. According to DeHedge, hedging is an effective strategy to combat the fluctuations in tokens and digital assets. The risk reduction for investors to a certain level is to minimize the potential return by the amount of hedging.

With practical goals, the creators of the DeHedge platform believe that in the future, it will evolve into a fully functional ecosystem that is integrated into the digital asset investment community with credibility, Expertise and unique products to protect property.

Risk insurance for ICO investment

Step 1: Investing and hedging Investors buy ICO A and check that ICO is insured and evaluated at DeHedge.com. If the ICO scores in DeHedge, the investor purchases the DeHedge Debit Card’s required amount at the exchange rate and uses it to pay the premium. Prices are calculated automatically.

Step 2: Auto Paid

In the event of a covered event, DeHedge automatically pays. DeHedge allows users to be supervised to adjust their payment settings.

In the event of a covered event, DeHedge automatically pays. DeHedge allows users to be supervised to adjust their payment settings.

For exchange rates

Step 1: Select Terms and Payment

Investor selects transaction tokens, term of coverage, and range of changes of the insured exchange rate. Investors must pay a premium for DeHedge or Etherium cards.

Step 1: Select Terms and Payment

Investor selects transaction tokens, term of coverage, and range of changes of the insured exchange rate. Investors must pay a premium for DeHedge or Etherium cards.

Step 2: Auto Paid

In the event of a covered event, DeHedge automatically pays. DeHedge allows users to be supervised to adjust their payment settings.

In the event of a covered event, DeHedge automatically pays. DeHedge allows users to be supervised to adjust their payment settings.

Why DeHedge do ICO?

As a result of the sale of DeHedge, the risk reserve was formed. These funds are used to mortgage for payments in the event of a covered event.

Starting ICO — April 2018

Additional information will be available by February 2018

As a result of the sale of DeHedge, the risk reserve was formed. These funds are used to mortgage for payments in the event of a covered event.

Starting ICO — April 2018

Additional information will be available by February 2018

Roadmap

Team

Management

Finance

Development

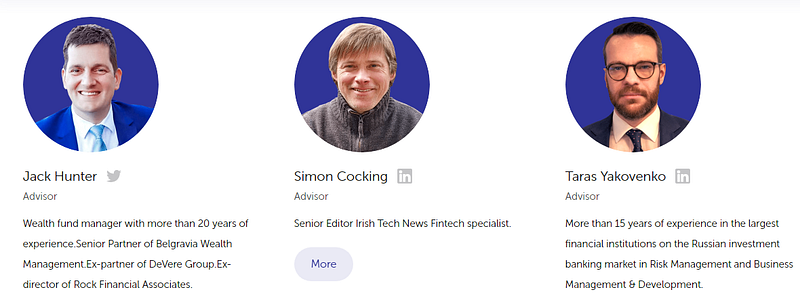

Advisors

Website : https://dehedge.com

Twitter : https://twitter.com/De_Hedge

Facebook : https://www.facebook.com/dehedgeofficial/

Telegram : https://t.me/Dehedge

Bounty Thread : https://bitcointalk.org/index.php?topic=3008651.0

Link bitcointalk : https://bitcointalk.org/index.php?action=profile;u=1578792

Notes: This post is my personal opinion about the Dehedge project as the part of advertising campaign of the Dehedge project.

Nhận xét

Đăng nhận xét